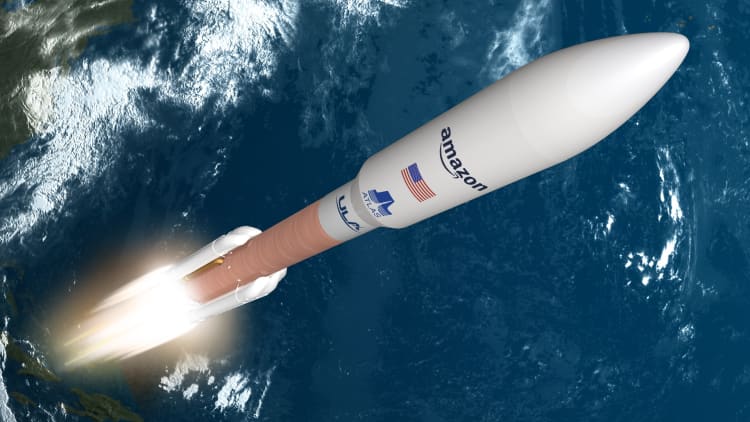

A United Launch Alliance Atlas V rocket is on the launch pad carrying Amazon’s Project Kuiper internet network satellites, which are expected to eventually rival Elon Musk’s Starlink system, at the Cape Canaveral Space Force Station in Cape Canaveral, Florida, U.S., April 9, 2025.

Steve Nesius | Reuters

In a social media post last month, Elon Musk had a message for Poland’s foreign minister, who had suggested that his country would seek alternatives to SpaceX’s Starlink if the satellite internet service “proves to be an unreliable provider.”

“Be quiet, small man,” Musk wrote on March 9, in response to the comment from Radoslaw Sikorski, who began working for the Polish government in the 1990s. “You pay a tiny fraction of the cost. And there is no substitute for Starlink.”

Poland has been paying for Starlink in war-torn Ukraine, where the service has been a vital tool in the fight against Russia. But Sikorski suggested it could start “looking for other suppliers.”

That possibility may soon be a reality, as Starlink will have to contend with fresh competition from Amazon‘s Project Kuiper, the e-commerce giant’s $10 billion-plus venture that’s six years in the making.

Amazon on Wednesday is planning to send its first batch of satellites into space from Cape Canaveral, Florida, aboard a United Launch Alliance rocket. If all goes according to plan, the launch — scheduled for between 7 p.m. ET and 9 p.m. ET and being livestreamed on ULA’s website — will bring Amazon one step closer to beginning commercial service for Kuiper, which aims to provide broadband internet connectivity from a constellation of more than 3,000 satellites.

The company is going after many of the same customers as Starlink. They include corporations, consumers who lack adequate internet access, and governments around the world. In recent months, Amazon has signed deals in the U.K., Australia and Indonesia. Poland hasn’t said specifically if it’s in talks with Kuiper or other Starlink rivals to provide service to Ukraine after the dustup with Musk.

As Kuiper heads to space, Starlink has a six-year head start. The SpaceX unit has built up a constellation of roughly 8,000 satellites and signed on more than 5 million customers around the world.

It also has a leader who now has a central role in the White House. After spending nearly $300 million to help Donald Trump win last year’s presidential election, Musk is one of the president’s top advisors, overseeing the Department of Government Efficiency, or DOGE, which is tasked with shrinking the federal government, including eliminating regulations.

On paper, the cozy relationship hasn’t exactly paid off. Tesla has lost almost half its market value since the inauguration, largely due to concerns surrounding Trump’s expansive tariffs. Musk spent the early part of this week publicly lashing out at top trade advisor Peter Navarro, calling him “dumber than a sack of bricks,” before later apologizing to bricks.

But despite the market disruption, SpaceX, which is privately held, is a major government contractor, putting it in a potentially much more favorable position versus its competition when trying to sign deals.

‘First buddy’

In February, the Federal Aviation Administration said it was testing Starlink technology in Atlantic City, New Jersey, and in Alaska. Other government agencies are exploring using Starlink at Musk’s request, and the Commerce Department said last month that it would revamp a $42.5 billion Biden-era program to expand high-speed internet access to be “tech-neutral,” a move viewed as a potential gift to Starlink.

“Is SpaceX winning the business because Elon is first buddy or because it’s the only solution?” said Chad Anderson, managing partner of space-focused venture capital firm Space Capital, in an interview. “When you have comparable competition and different solutions online, then you’ll be able to tell if it’s favoritism.”

In recent months, DOGE members, including some who work for Musk’s companies, have visited NASA, the Department of Defense and the FAA, which have contracts with SpaceX and competitors like Amazon, Jeff Bezos’ Blue Origin, ULA, Northrop Grumman and space startup Rocket Lab.

Some SpaceX rivals are concerned that DOGE’s work at federal agencies may give it access to databases that contain sensitive competitor information, according to a person familiar with the matter who asked not to be named because the discussions are confidential.

Scott Amey, general counsel for watchdog group Project on Government Oversight, said there’s little transparency around what systems and information DOGE employees are able to access. DOGE is also carrying out widespread cuts at agencies tasked with regulating Musk’s businesses, Amey said.

“There’s too many conflicts of interest to count,” Amey said.

A demonstrator holds a sign and a flag during a protest outside SpaceX and Starlink facilities in Redmond, Washington, U.S., February 26, 2025.

David Ryder | Reuters

However, Musk’s tangled web of business and political interests could work in Kuiper’s favor in a market thirsty for choice.

Starlink currently dominates the low Earth orbit satellite internet market, controlling almost two-thirds of all active satellites. Low Earth orbit refers to the region of space that’s within 1,200 miles above the planet’s surface. Starlink’s closest competitor is SoftBank-backed OneWeb, which had more than 650 satellites in orbit as of last October.

“When you’re the only game in town, it gives you a lot of power,” Anderson said. “Amazon is one of the only ones that can do this and compete with them head on. With more options, power shifts to the buyers.”

Kuiper has received significant interest from governments and enterprises that are eager to work with another satellite internet operator that’s “not so beholden to the whims of an executive,” according to a separate person familiar with the matter.

Taiwan’s government ruled out Starlink due to Musk’s business ties in China and is in talks with Kuiper about using its network, according to the Financial Times. Russian President Vladimir Putin also asked Musk not to activate Starlink in Taiwan, The Wall Street Journal reported, as a favor to Chinese President Xi Jinping.

A potential Starlink deal with the Italian government has reportedly stalled due to Musk’s ties to Trump and the president’s fracturing alliance with Europe. And Canadian governments in Ottawa and Quebec have canceled Starlink contracts after Trump announced sweeping tariffs against the country.

SpaceX didn’t respond to a request for comment.

Amazon is taking a different approach to entering new markets.

In countries such as Papua New Guinea, Namibia, Cameroon and the tiny Polynesian island nation of Niue, SpaceX has sold Starlink services to the public before receiving the necessary licenses, angering regulatory officials. Consumers in some countries have been so desperate for internet access that they’ve reportedely operated Starlink terminals illegally, even at risk of facing fines or jail time.

By contrast, Amazon has aimed to be a “sensible voice in the room” with regulators, a former Kuiper employee told CNBC.

Another ex-employee recounted telling a regulator that Amazon would operate differently than Starlink, speaking with officials before standing up its service. The response was “a look of relief,” the former employee said.

Running with the pack

While Amazon doesn’t have a seat at the table in the Trump administration, Bezos, the company’s founder and top shareholder, has tried to establish a friendly rapport with the president, as has Amazon, now led by CEO Andy Jassy.

Last summer, Bezos commended Trump for “grace under literal fire” following the attempted assassination of Trump at a Pennsylvania rally. At The Washington Post, Bezos axed an editorial endorsement of Democratic nominee Kamala Harris, and later narrowed the topics covered by the newspaper’s opinion pages to those supporting “personal liberties and free markets.” He’s dined with Trump at his Mar-a-Lago club in Florida, and stood alongside top tech executives at Trump’s inauguration on Jan. 20.

Amazon, for its part, donated to Trump’s inaugural fund, and spent a reported $40 million to license a documentary about first lady Melania Trump. Last month, Amazon said it would begin streaming seasons of “The Apprentice,” the reality TV show that helped propel Trump to fame.

It’s a stark reversal from Trump’s first term in the White House, when the president repeatedly attacked Bezos and his companies and served up the nickname “Jeff Bozo.” Bezos, who was CEO of Amazon until 2021, blamed Trump’s “behind-the-scenes attacks” for the company’s loss of a multibillion-dollar Department of Defense contract.

Craig Berman, a longtime advisor to Bezos who spent more than a decade at Amazon as a top public relations executive, said that while the company’s overtures to Trump could be viewed as “bending the knee,” it’s no different from attempts to lobby previous administrations.

“Conceptually the outcome is no different than any other president at any other time,” Berman said. “This just happened to be public, and maybe that’s a good thing.”

For now, Amazon’s Kuiper team is focused on the tall task of getting satellites into space. The company has to meet a Federal Communications Commission deadline to launch half of its total constellation, or 1,618 satellites, by July 2026.

Amazon has booked more than 80 launches to deploy dozens of satellites at a time, including from SpaceX. Wednesday’s mission is “the first step in that process,” with service expected to come online later this year, the company said.

“We’ve done extensive testing on the ground to prepare for this first mission, but there are some things you can only learn in flight,” Rajeev Badyal, vice president of Kuiper and a former SpaceX executive, said in a statement. “This will be the first time we’ve flown our final satellite design and the first time we’ve deployed so many satellites at once.”