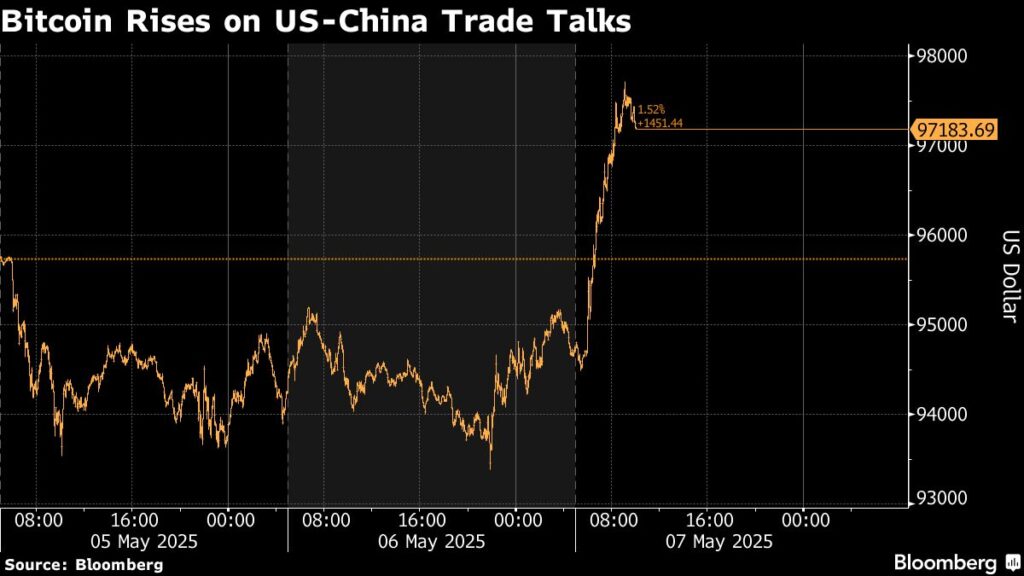

(Bloomberg) — Bitcoin rose alongside Asian stocks and a strengthening dollar after news that the US and China plan to hold trade talks.

Most Read from Bloomberg

The largest digital asset rose about 3.2% to top $97,500 on Wednesday morning in Singapore before paring gains, while second-ranked Ether climbed as much as 4.2%.

The rally followed news that US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will meet with the Chinese government this week in Switzerland, raising hopes that the world’s two largest economies can reach an agreement that may ease trade tensions. Meanwhile, India said in a statement early Wednesday that it had conducted targeted military strikes against Pakistan, which in turn said it had shot down five Indian jets.

Digital-asset prime brokerage FalconX Ltd. has seen “renewed interest for Bitcoin topside” with the market “appearing optimistic that the trade talks over the weekend will be positive,” said Sean McNulty, derivatives trading lead of APAC at the company.

Demand for upside exposure in the options market has increased with activity concentrated in call options with a strike price of $100,000, according to data compiled by Deribit, the largest crypto derivatives exchange.

Traders so far appear to be “totally ignoring” the conflict in Pakistan, McNulty added. Digital-asset investors will also have an eye on Wednesday’s rate decision by the Federal Reserve, with policymakers expected to stay on hold.

“We’re seeing a broad-based risk-on sentiment today, largely driven by the reopening of trade dialogue between the US and China. Global equities are up, gold is retreating, and the USD is modestly higher. This is a classic risk-on setup that is also lifting crypto markets,” QCP Capital trader Yuan Rong Tan said.

Bitcoin hit a record of $109,241 in January riding a wave of optimism about US President Donald Trump’s pro-crypto agenda. Once an industry skeptic, Trump pivoted to become an ardent supporter of the digital-assets space on the campaign trail and has pushed for supportive legislation in the early innings of his presidency. But his sweeping tariff program and subsequent market turmoil have knocked backed crypto prices in recent months.

Bitcoin was trading at $96,387 and Ether at $1,828 as of 6:52 a.m. in London.