(Bloomberg) — The culture clash between Bitcoin enthusiasts and gold bugs is about to be played out in the world of exchange-traded funds.

Most Read from Bloomberg

Tidal Financial Group this week filed to launch a pair of long-short trades — pitting the world’s biggest cryptocurrency against the shiny metal, and vice versa — offering investors a high-conviction bet on the best alternative hedge, in one fell swoop.

Packaged under the Battleshares brand, the novel exchange-traded funds would monetize the long-running debate about the ultimate store of value for those fearing everything from trade wars and geopolitical stresses to fiscal and monetary largesse. The ideological divide among the retail and institutional masses has raged since Bitcoin was born from the ashes of the 2008 crisis, and it comes just as both assets have surged over the past year on starkly different narratives.

The ETFs would, if launched, use a number of different tools to do so, including short sales of securities, swaps and options, according to paperwork submitted to the US Securities and Exchange Commission.

Battleshares declined to comment.

“This is a kind of ‘victory’ for me,” said Dhaval Joshi, chief strategist at Counterpoint, who has long argued Bitcoin and gold belong to the same “non-confiscatable” asset class — immune to inflation, capital controls, or seizure. “Bitcoin will gradually grab market share from gold. So long BTC/short gold should trend higher over time, while short BTC/long gold will trend lower.”

Still, the zero-sum proposition has critics.

“It feels gimmicky and unnecessary,” said Brent Donnelly, president of Spectra FX Solutions. “Most people bullish on Bitcoin are also bullish on gold. These ETFs just add friction to a trade investors could already make by pairing low-cost ETFs like IBIT and GLD,” referring to BlackRock Inc.’s spot Bitcoin ETF and State Street Corp.’s gold fund — both of which have extremely low fees.

This year, gold has notched successive records on haven demand as the trade war stoked fears over the safety of US assets, while Bitcoin plunged in the tariff-spurred turmoil in early April in sympathy with risky stocks. Now, as the White House seeks to ink trade agreements, Bitcoin has roared back in an era in which the US government is going all-in on digital finance.

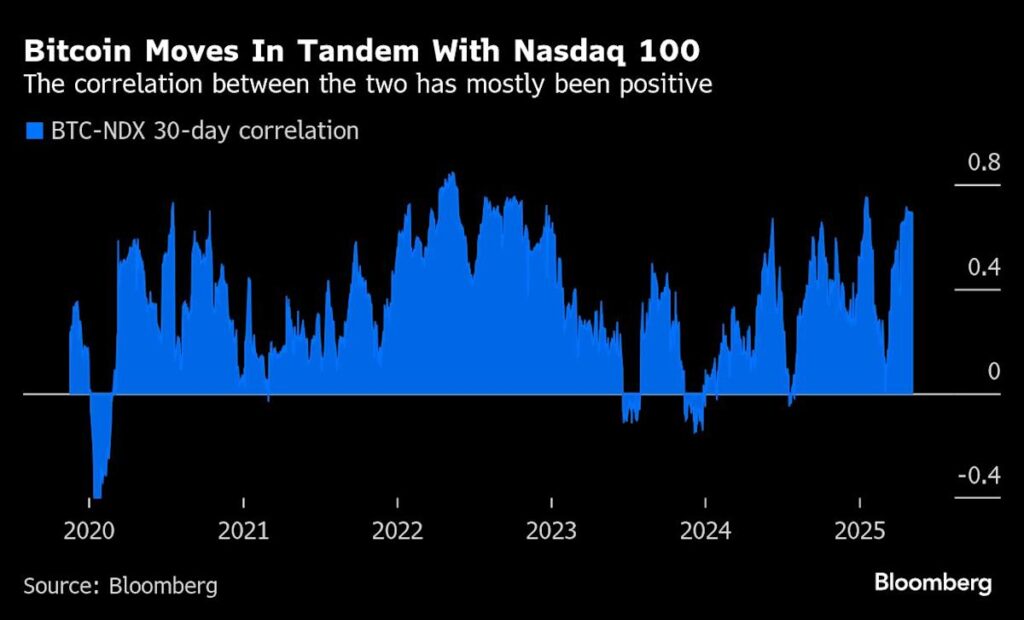

“Bitcoin continues to trade as a risky asset, tracking Nasdaq very closely with a few exceptions,” said Donnelly. “Gold is more of a ‘Sell America’ proxy these days.”

Regardless of the diverse storylines anchoring both assets, gold and crypto have been touted by wealth managers as diversifying assets that offer insurance against the risk of currency debasement and related cracks in the traditional financial order. These are grand claims and FOMO may be more to do with it. Investors have poured more than $14 billion into four major gold ETFs this year alone and $8 billion has been added to the four top Bitcoin ETFs.

Risk Appetite Endures

Battleshares, the upstart product manager, has been seeking to seize on the next evolution of pair trading. Thus far, it’s only product is Battleshares TSLA vs F ETF (ticker ELON), a long position on Elon Musk’s Tesla Inc. paired with a short position on Ford Motor Co., according to its website. Launched in February with a 1.29% expense ratio, the fund has barely nabbed $1 million in assets. The firm has since filed for a slew of such ETFs that seek to employ long-short bets including Coinbase Global Inc. versus Wells Fargo & Co. and Eli Lilly & Co. against Taco Bell-owner Yum! Brands Inc., among others. Battleshares isn’t the first to test pair-trading strategies.

Increasingly, smaller firms and mainstream Wall Street issuers alike have flooded the market with typically higher-fee ETFs offering souped up securities and derivatives products this year with differing leverage and return profiles. Derivatives-based ETFs, a fast-expanding category that includes single-stock funds that offer juiced up or inverse returns on one company, have boomed since 2019 when US regulators eased constraints for launching new funds. Many of these are popular among the retail-trading crowd whose appetite for risk pushes them to the riskiest corners of the market on the promise of big payouts on volatile moves.

Still, risk appetite remains as markets staged a gravity-defying rebound last month. And this week, Bitcoin topped $100,000 on Thursday as gold declined following the Federal Reserve’s decision to keep rates steady.

The tussle between the two may very well continue but to Charlie Morris of Bytetree Asset Management, Bitcoin should beat gold and take away the latter’s market share long term.

“I believe Bitcoin and gold both benefit from this era of macroeconomic uncertainty, but at different times,” said the chief investment officer, whose firm runs BOLD, an exchange-traded product that allocates both to gold and Bitcoin. “Gold tends to do better when there is geopolitical uncertainty, and Bitcoin when things are going well.”

–With assistance from Vildana Hajric.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.